Bookkeeping

Debt to Equity Ratio D E Formula + Calculator

The result is that Starbucks has an easy time borrowing money—creditors trust that it is in a solid financial position and can be expected to pay them back in full. If its assets provide large earnings, a highly leveraged corporation may have a low debt ratio, making it less hazardous. Contrarily, if the company’s assets yield low returns, a low debt ratio does not automatically translate into profitability. The concept of comparing total assets to total debt also relates to entities that may not be businesses. For example, the United States Department of Agriculture keeps a close eye on how the relationship between farmland assets, debt, and equity change over time. A ratio greater than 1 shows that a considerable amount of a company’s assets are funded by debt, which means the company has more liabilities than assets.

Role of Debt-to-Equity Ratio in Company Profitability

Ultimately, businesses must strike an appropriate balance within their industry between financing with debt and financing with equity. The company must also hire and train employees in an industry with exceptionally high employee turnover, adhere to food safety regulations for its more than 18,253 stores in 2022. Let’s look at a few examples from different industries to contextualize the debt ratio. The interest paid on debt also is typically tax-deductible for the company, while equity capital is not.

What Is the Debt-to-Equity (D/E) Ratio?

In that case, investors may worry that the company isn’t taking advantage of potential growth opportunities. Companies that don’t need a lot of debt to operate may have debt-to-equity ratios below 1.0. The company can use the funds they borrow to buy equipment, inventory, or other assets — or to fund new projects or acquisitions.

Why are D/E ratios so high in the banking sector?

The debt-to-equity (D/E) ratio can help investors identify highly leveraged companies that may pose risks during business downturns. Investors can compare a company’s D/E ratio with the average for its industry and those of competitors to gain a sense of a company’s reliance on debt. The debt-equity ratio can be a valuable tool for evaluating a company’s financial standing, but it’s important to use other metrics as well to get the clearest picture possible. The debt-to-equity ratio does not consider the company’s cash flow, reliability of revenue, or the cost of borrowing money. The debt ratio aids in determining a company’s capacity to service its long-term debt commitments.

- Last, the debt ratio is a constant indicator of a company’s financial standing at a certain moment in time.

- As an individual investor you may choose to take an active or passive approach to investing and building a nest egg.

- In some cases, companies can manipulate assets and liabilities to produce debt-to-equity ratios that are more favorable.

- As a result, borrowing that seemed prudent at first can prove unprofitable later under different circumstances.

- This tells us that Company A appears to be in better short-term financial health than Company B since its quick assets can meet its current debt obligations.

The D/E Ratio for Personal Finances

Conversely, if the D/E ratio is too low, managers may issue more debt or repurchase equity to increase the ratio. Depending on the industry they were in and the D/E ratio of competitors, this may or may not be a significant difference, but it’s an important perspective to keep in mind. In this guide, we’ll explain everything you need to know about the D/E ratio to help you make better financial decisions. Upon plugging those figures into our formula, the implied D/E ratio is 2.0x.

How do companies improve their debt-to-equity ratio?

This tells us that Company A appears to be in better short-term financial health than Company B since its quick assets can meet its current debt obligations. If preferred stock appears on the debt side of the equation, a company’s debt-to-equity ratio may look riskier. A company’s accounting policies can change the calculation of its debt-to-equity. For example, preferred stock is sometimes included as equity, but it has certain properties that can also make it seem a lot like debt. Having to make high debt payments can leave companies with less cash on hand to pay for growth, which can also hurt the company and shareholders. And a high debt-to-equity ratio can limit a company’s access to borrowing, which could limit its ability to grow.

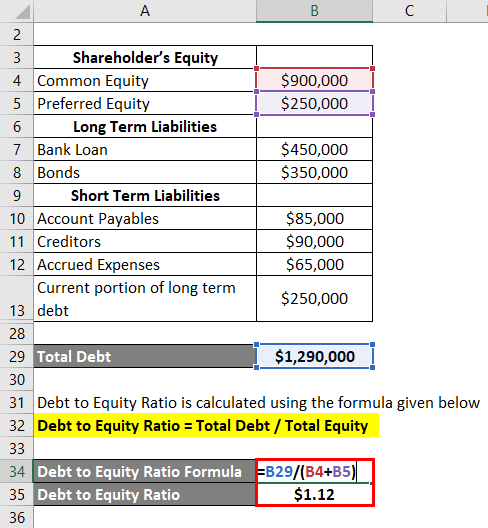

Now We will calculate the Debt Equity Ratio using the debt to equity ratio formula. Let’s take a simple example to illustrate the ideal debt to equity ratio formula. If a company cannot pay the interest and principal on its debts, whether as loans to a bank or in the form of bonds, it can lead to a credit event. The D/E ratio is one way to look for red flags that a company is in trouble in this respect.

However, a low D/E ratio is not necessarily a positive sign, as the company could be relying too much on equity financing, which is costlier than debt. However, in this situation, the company is not putting all that cash to work. Investors may become dissatisfied with the lack of investment or they may demand a share of that cash in the form of dividend payments. Some analysts like to use a modified D/E ratio to calculate the figure using only long-term debt.

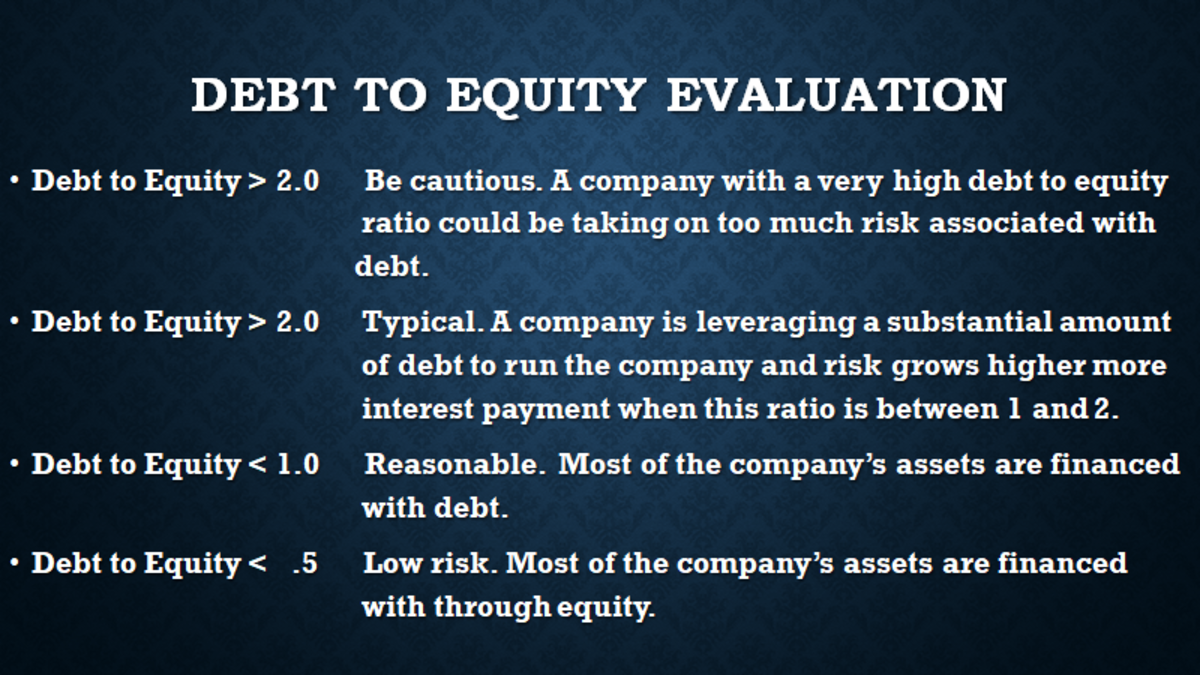

“Ratios over 2.0 are generally considered risky, whereas a ratio of 1.0 is considered safe.” For a mature company, a high D/E ratio can be a sign of trouble that the firm will not be able to service its debts and can eventually lead to a credit event such as default. In all cases, D/E ratios should be considered relative to a company’s industry and growth stage. If a company has a D/E ratio of 5, but the industry average is 7, this may not be an indicator of poor corporate management or economic risk. There also are many other metrics used in corporate accounting and financial analysis used as indicators of financial health that should be studied alongside the D/E ratio. A company’s management will, therefore, try to aim for a debt load that is compatible with a favorable D/E ratio in order to function without worrying about defaulting on its bonds or loans.

The nature of the baking business is to take customer deposits, which are liabilities, on the company’s balance sheet. And, when analyzing a company’s debt, you would also want to consider how mature the debt is as well as cash flow relative to interest payment expenses. When interpreting the D/E ratio, you always need to put it in context by principles of sound tax policy examining the ratios of competitors and assessing a company’s cash flow trends. As an example, many nonfinancial corporate businesses have seen their D/E ratios rise in recent years because they’ve increased their debt considerably over the past decade. Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2).

What counts as a good debt ratio will depend on the nature of the business and its industry. Generally speaking, a debt-to-equity or debt-to-assets ratio below 1.0 would be seen as relatively safe, whereas ratios of 2.0 or higher would be considered risky. Some industries, such as banking, are known for having much higher debt-to-equity ratios than others.